[最新] yield to maturity formula in excel 900309-Yield to maturity formula semi-annual coupon excel

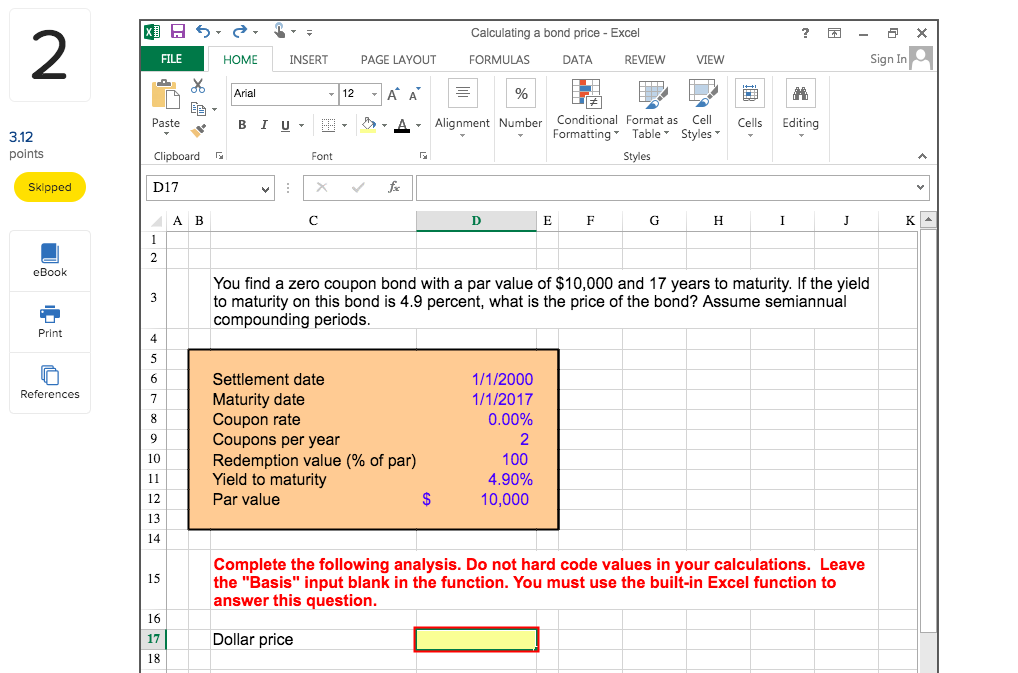

The formula for calculating the yield to maturity on a zerocoupon bond is Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Consider a $1,000 zerocoupon bond that hasWe use the bondequivalent yield convention to calculate the annual YTM So, YTM = 300x 2 = 6% On the other hand, the effective annual yield is (103) 2 – 1 = 609% Again, note that YTM is a bond equivalent yield (BEY) which is calculated by applying simple interest rules So, we annualize the rate by multiplying, instead of using raise to the powerRedemption is the value received by the bondholder at the expiry of the bond representing the repayment of principal;

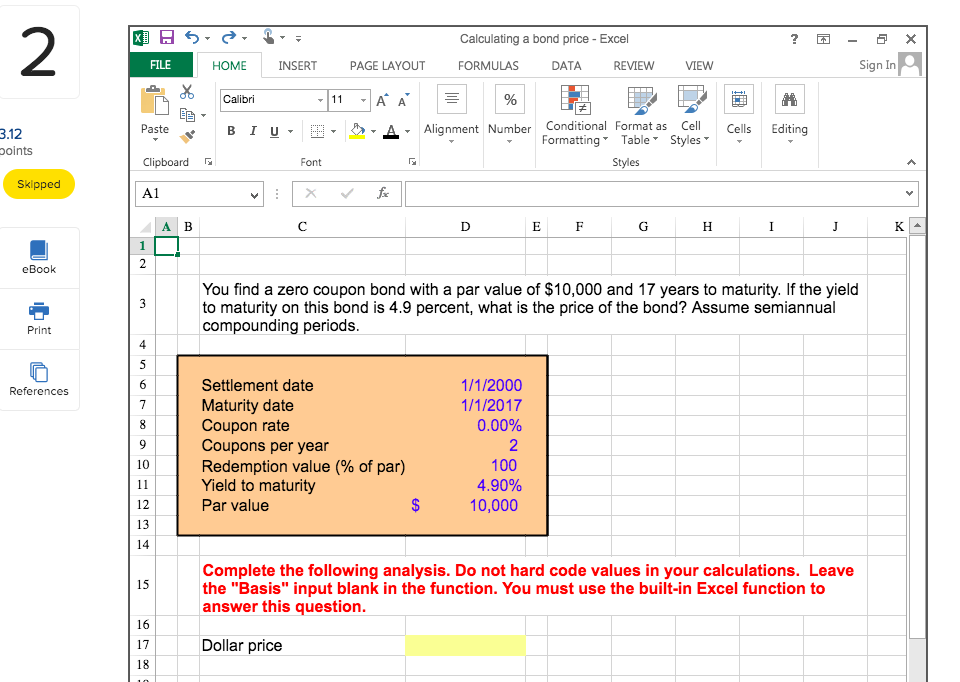

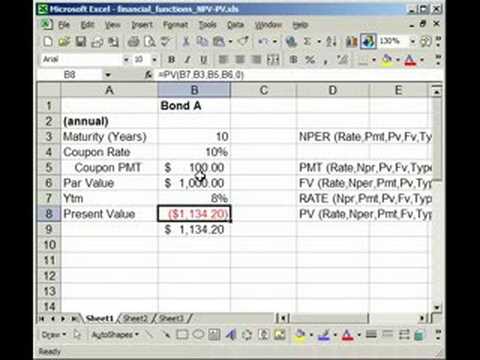

How To Calculate The Yield To Maturity Of A Bond Or Cd With Excel Youtube

Yield to maturity formula semi-annual coupon excel

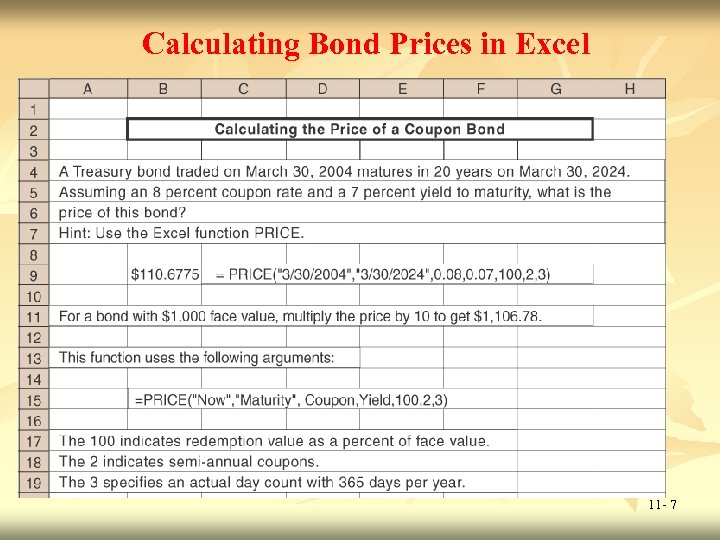

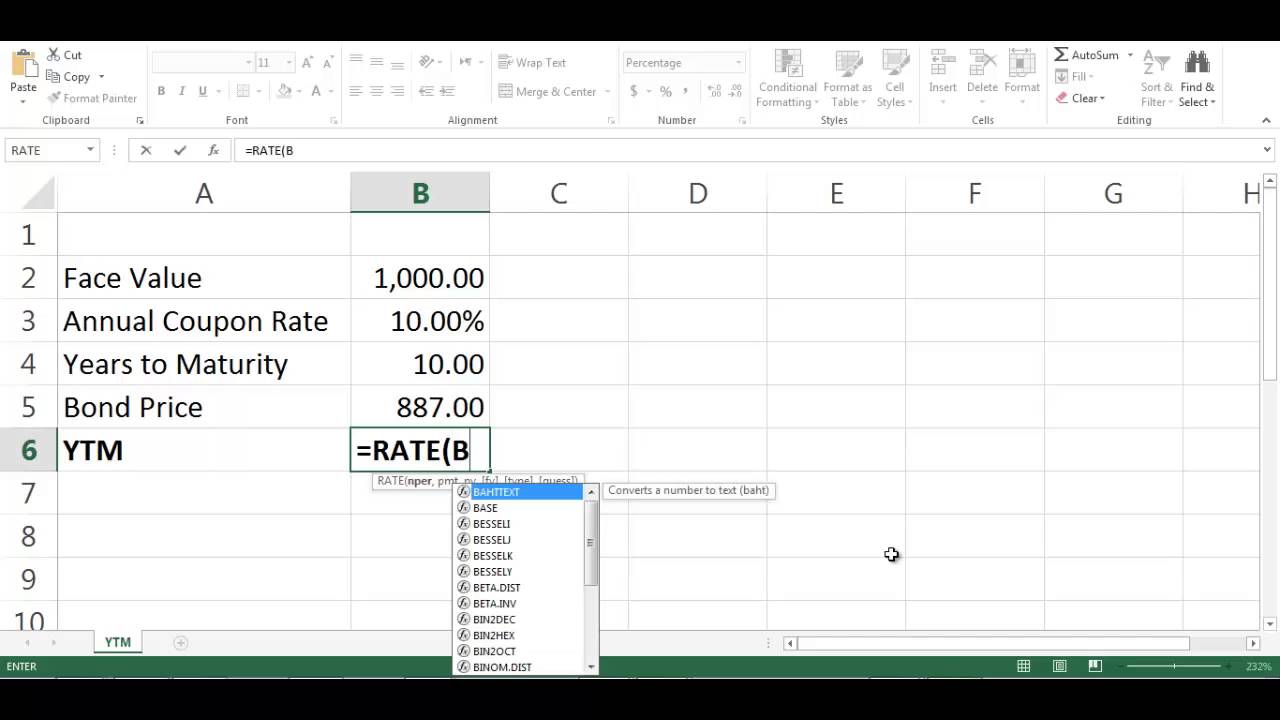

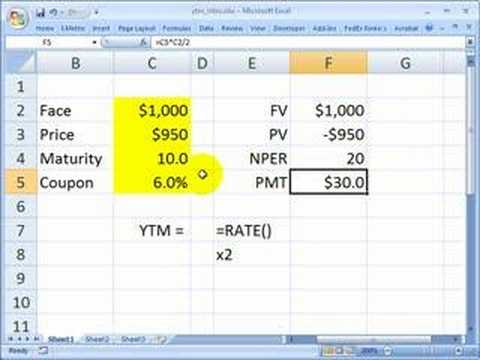

Yield to maturity formula semi-annual coupon excel-YIELD() Using a spreadsheet to calculate Fixed Rate Bond yield Suppose we have a $1000 face value bond with 6 years to maturity, a coupon rate of 8%, and a price of $911 If the bond makes semiannual payments, what is its YieldToMaturity ?Typically, pmt includes principal and taxes If pmt is omitted, you must include the Outputs Coupon Number of Periods Yield to Maturity (YTM) 750% Formula used in cell C14 =RATE(C13,C12,C9,C5)*C7 nper Fv (Optional) The future value, or a cash balance you wa payment is made If fv is omitted, it is assume loan, for example, is 0)

How To Calculate Bond Yield In Excel 7 Steps With Pictures

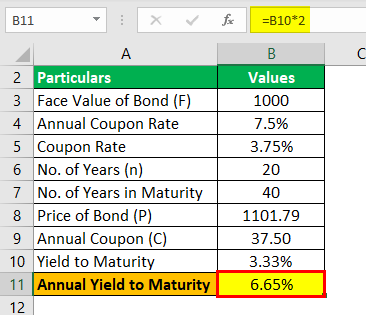

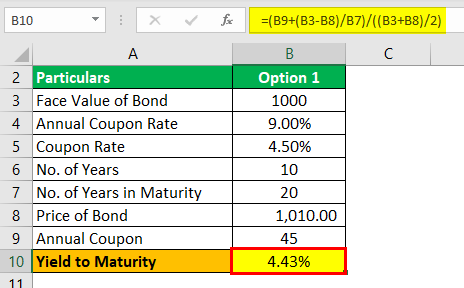

Yield to Maturity (YTM) Formula Excel Template Prepared by Dheeraj Vaidya, CFA, FRM visit dheeraj@wallstreetmojocom Particulars Values Face Value of Bond (F) 1000 Annual Coupon Rate 8% No of years in Maturity (n) 12 Price of the Bond (P) 940 Annual Coupon (C) 8000 Yield to Maturity 876% Assume that the price of the bond is $940 with the face value of bond $1000The YIELDMAT function returns the annual yield of a security that pays interest at maturity In the example shown, the formula in F5 is = YIELDMAT(C9, C7, C8, C6, C5, C10) with these inputs, the YIELDMAT function returns 0081 which, or 810% when formatted with the percentage number format/ Excel Formula for Yield to Maturity The YTM is easy to compute where the acquisition cost of a bond is at par and coupon payments are effected annually In such a situation, the yieldtomaturity will be equal to coupon payment However, for other cases, an approximate YTM can be found by using a bond yield table

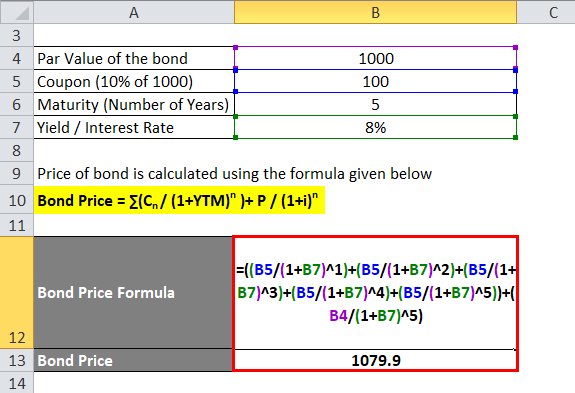

N = number of semiannual periods left to maturity Let's take an example to understand how to use the formula Let us find the yieldtomaturity of a 5 year 6% coupon bond that is currently priced at $850 The calculation of YTM is shown below Note that the actual YTM in this example is 987%Mathematically, the formula for bond price using YTM is represented as, Bond Price = ∑ Cash flowt / (1YTM)t Where, t No of Years to Maturity On the other hand, the term "current yield" means the current rate of return of the bond investment computed on the basis of the coupon payment expected in the next one year and the current market price The formula for current yield is expressed as expected coupon payment of the bond in the next one year divided by its current market price PV = P ( 1 r ) 1 P ( 1 r ) 2 ⋯ P Principal ( 1 r ) n where PV = present value of the bond P = payment, or coupon rate × par value ÷ number of payments per year r = required

The yield to maturity is found in the present value of a bond formula For calculating yield to maturity, the price of the bond, or present value of the bond, is already known Calculating YTM is working backwards from the present value of a bond formula and trying to determine what r is Example of Yield to Maturity FormulaYou will want a higher price for your bond so that yield to maturity from your bond will be 45% Let's calculate now your bond price with the same Excel PV function =PV (450%/4, 4*10, 1500, 100,000) = $112, So, you will be able to sell your bond at $112, with a premium of amount $12,Solution Here we have to understand that this calculation completely depends on annual coupon and bond price It completely ignores the time value of money, frequency of payment, and amount value at the time of maturity Step 1 Calculation of the coupon payment Annual Payment =$1800*9% Annual Payment = $162

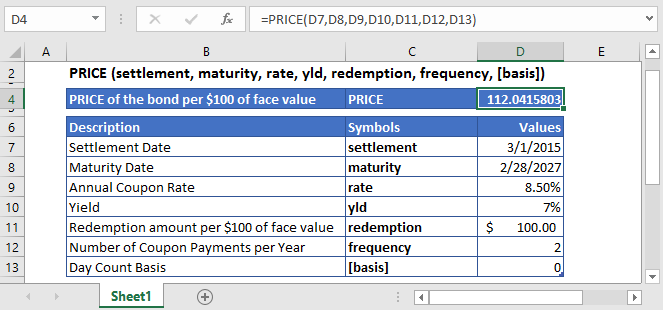

How To Calculate Bond Price In Excel

Bond Pricing Formula How To Calculate Bond Price

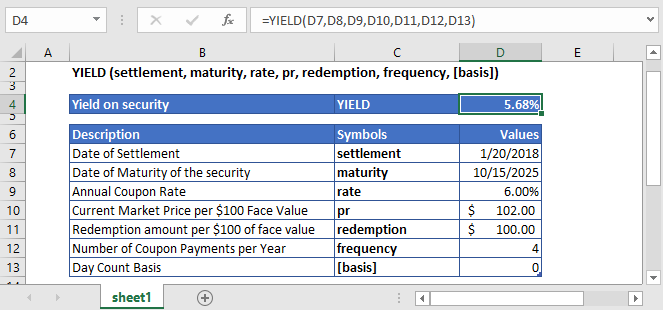

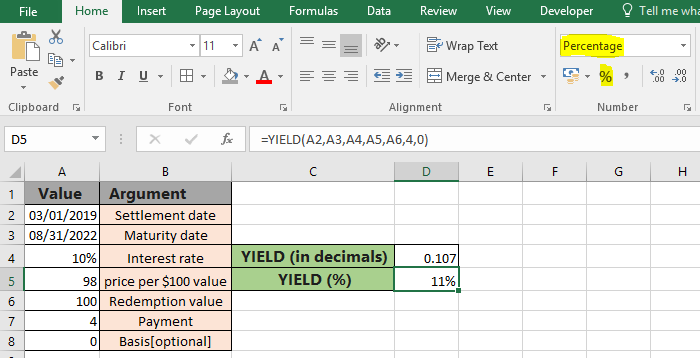

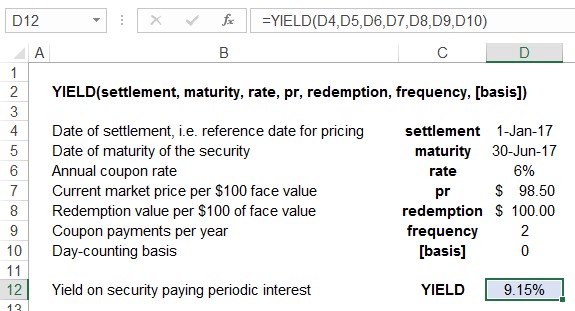

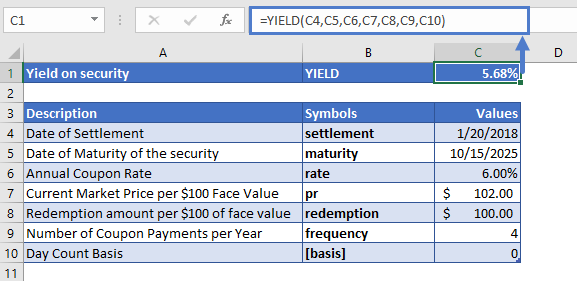

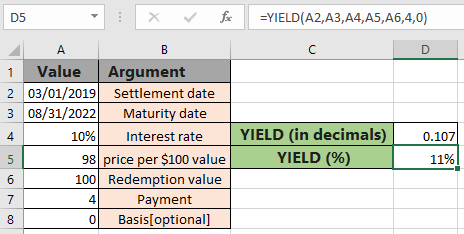

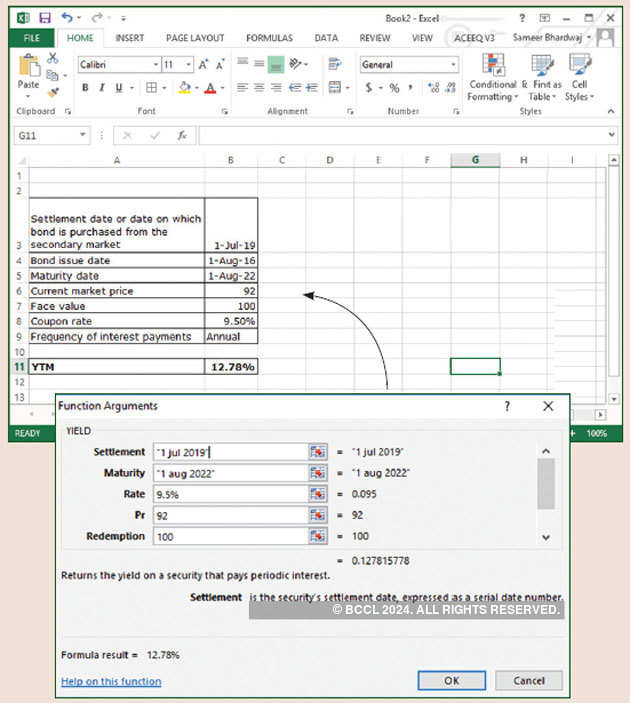

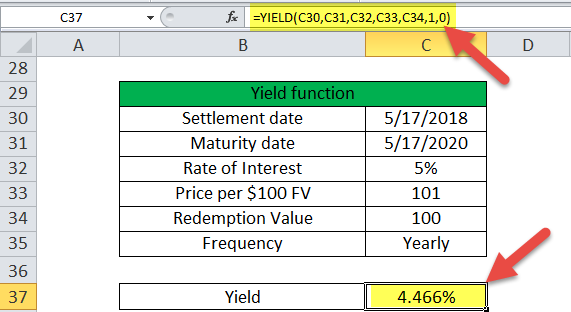

Yield is different from the rate of return, as the return is the gain already earned, while yield is the prospective return Formula = YIELD(settlement, maturity, rate, pr, redemption, frequency, basis) This function uses the following arguments Settlement (required argument) – This is the settlement date of the security It is a date after the security is traded to the buyer that is after the issue dateThe yield to worst is the lowest potential return an investor can get from investing in a bond, assuming thereThe exact equation for yield to maturity is C(1R)^(1) C(1R)^(N) F(1R)^(N) = B, where R is the YTM Even if you know the values for C, F, B and N, this equation cannot be solved for R However, the simple yield to maturity formula gives a good approximation for R

Best Excel Tutorial How To Calculate Yield In Excel

Yield Formula Excel Example

Use Basis of ACTUAL/ACTUAL Days in a year 365 Tenor in years 6 Settlement date 3 Jan Maturity date 1 Jan 26 Annual coupon rate 8% Bond priceIf pmt is omitted, you must include the Outputs Coupon Number of Periods Yield to Maturity (YTM) 750% Formula used in cell C14 =RATE (C13,C12,C9,C5)*C7 nper Fv (Optional) The future value, or a cash balance you wa payment is made If fv is omitted, it is assume loan, for example, is 0)How to use =Rate in MS Excel to calculate YTM for bonds

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

How To Calculate Ytm And Effective Annual Yield From Bond Cash Flows In Excel Microsoft Office Wonderhowto

The formula used to calculate the Yield is =YIELD (C4,C5,C6,C7,C8,C9,C10) The YIELD function calculates the yield of the 10year bond YIELD = % As recommended the values of the settlement and maturity date arguments are entered as a reference to the cells containing datesHere we have to understand that this calculation completely depends on annual coupon and bond price It completely ignores the time value of money, frequency of payment, and amount value at the time of maturity Step 1 Calculation of the coupon payment Annual Payment =$1800*7% Annual Payment =$126Y Yield to maturity P = C/(1y)^1 C/(1y)^2 C/(1y)^3 C/(1y)^n F/(1y)^n Now let's assume C, F and P are given, I want to obtain y with a VBA tool, what's my play?

How To Calculate Pv Of A Different Bond Type With Excel

Calculating The Annual Yield Of A Security That Pays Interest At Maturity Yieldmat

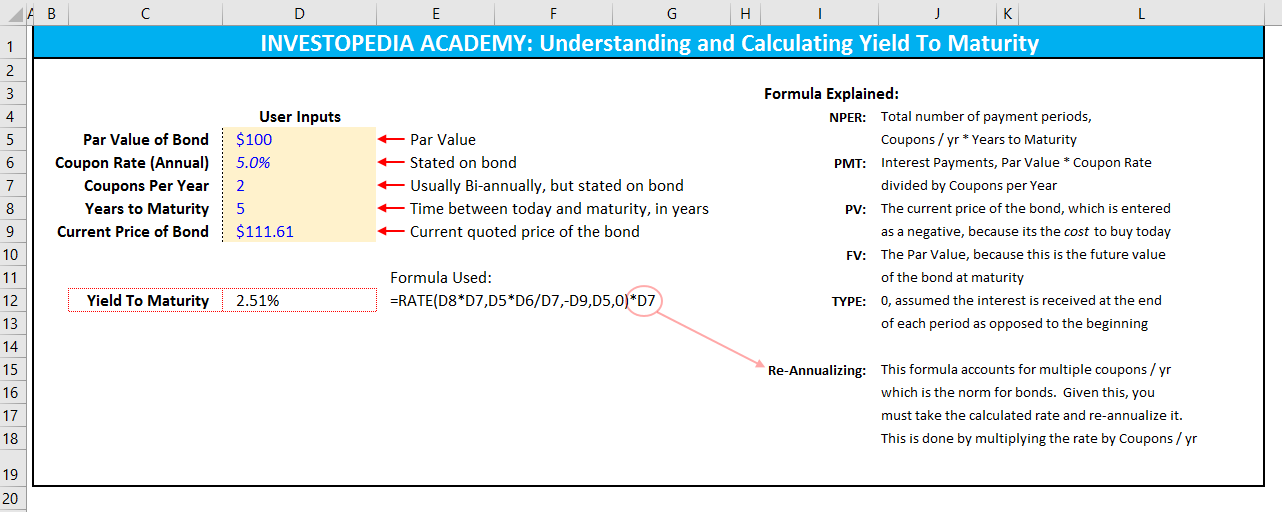

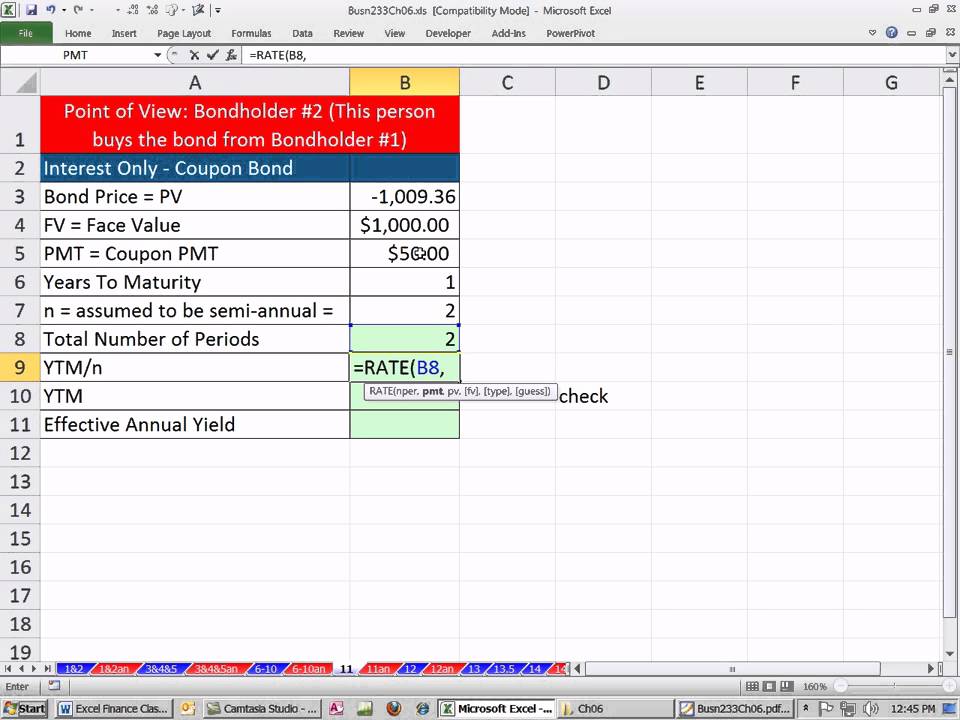

An example of finding the YTM (yield to maturity) of a bond using the =RATE formula in ExcelThere is no single formula for calculating bond yields Instead, an estimate is calculated using an iterative process eg "RATE" function in Excel;Yield to Maturity is calculated using the formula given below YTM =Coupon Prorated Discount /(Redemption Price Purchase Price)/2 YTM = 630 ($1350 / 5) / ($104 $90) / 2

Q Tbn And9gcspsw0gvryuir4hbunmr9ryyqtt9uvaiwo4js Vmypouh4p4lqk Usqp Cau

Solved Calculate The Ytm Using Excel Formula And Cells S Chegg Com

Call/Maturity Date Total Interest Yield Price Difference Yield Total Yield Annualized 2 years 97% (3%) 67% 335% 4 years 194% (3%) 164% 41% 5 years (maturity) 2425% (3%) 2125%Key in the Formula Column A is down so you now move on to column B Column A is down so you now move on to column B Go to B5 (your currency cell) and key in the formula =B1*(1B2/)^B4With that additional information, using the Yield() function to calculate the yield to maturity on any date is simple Insert the following function into B18 =YIELD(B6,,B4,B13,,B10,B11) and you will find that the YTM is 950% Notice that we didn't need to make any adjustments to account for the semiannual payments

Debt Capital Market An Excel To Justify Your Bonus In Dcm Desk

Solved All Answers Must Be Entered As A Formula Click Ok Chegg Com

As recommended, the date arguments have been input as references to cells containing dates3 =YIELD ( B1, B2, 10%, 101, 100, 4 ) The above function calculates the yield to be 976% Note that, in the above example The basis argument has been omitted, so the default US (NASD) 30/360 day method is used;Yield to Maturity is calculated using the formula given below YTM =Coupon Prorated Discount /(Redemption Price Purchase Price)/2 YTM = 630 ($1350 / 5) / ($104 $90) / 2

Yield Formula Excel Example

Compute The Current Bond Price Answer Must Be In Excel Formula Ninja Co Issued 14 Year Bonds Homeworklib

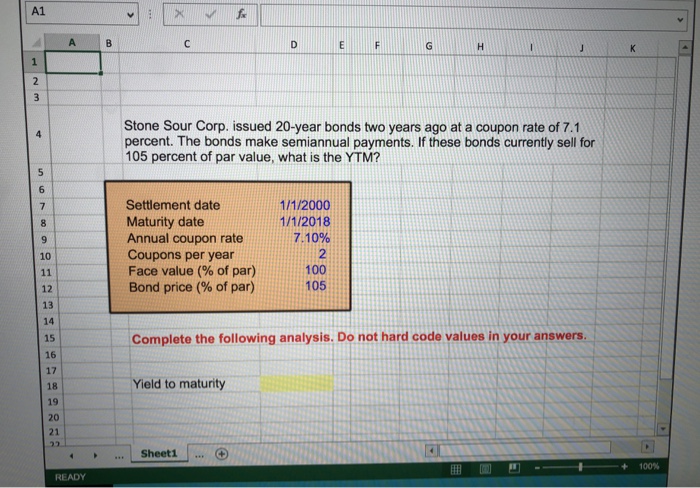

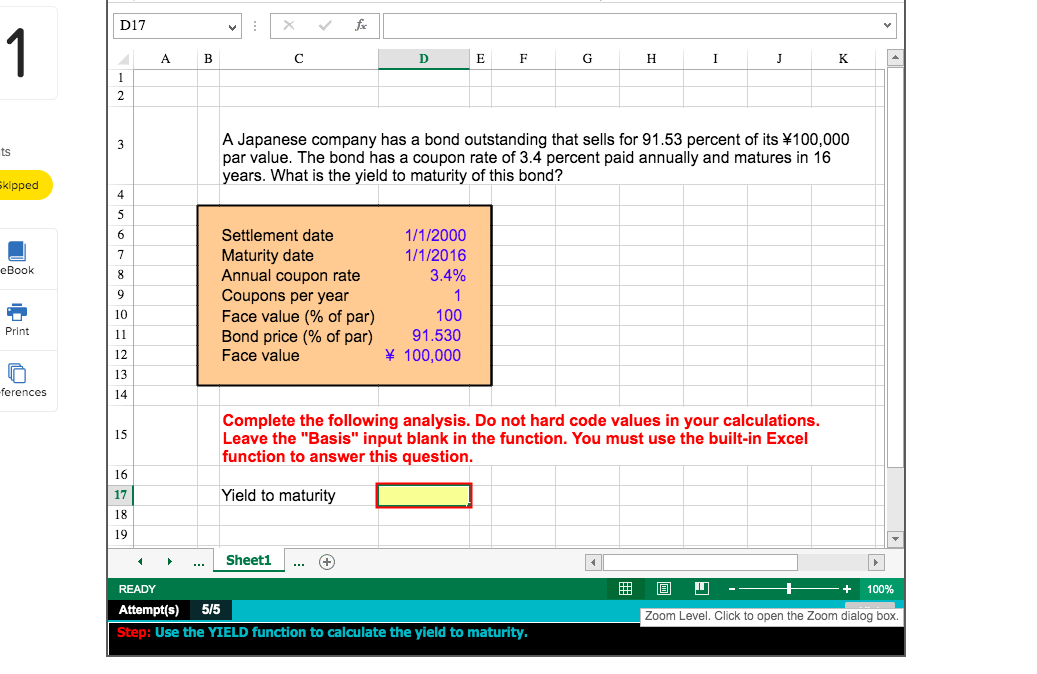

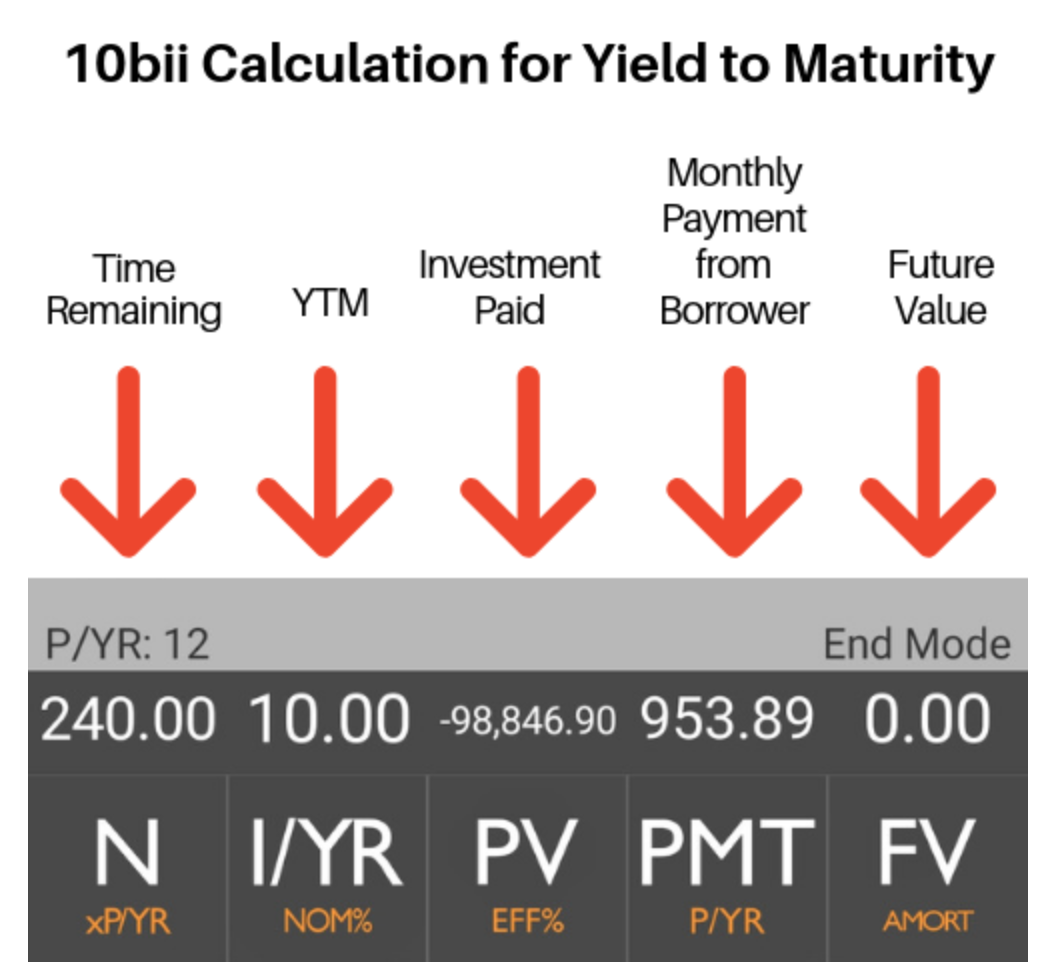

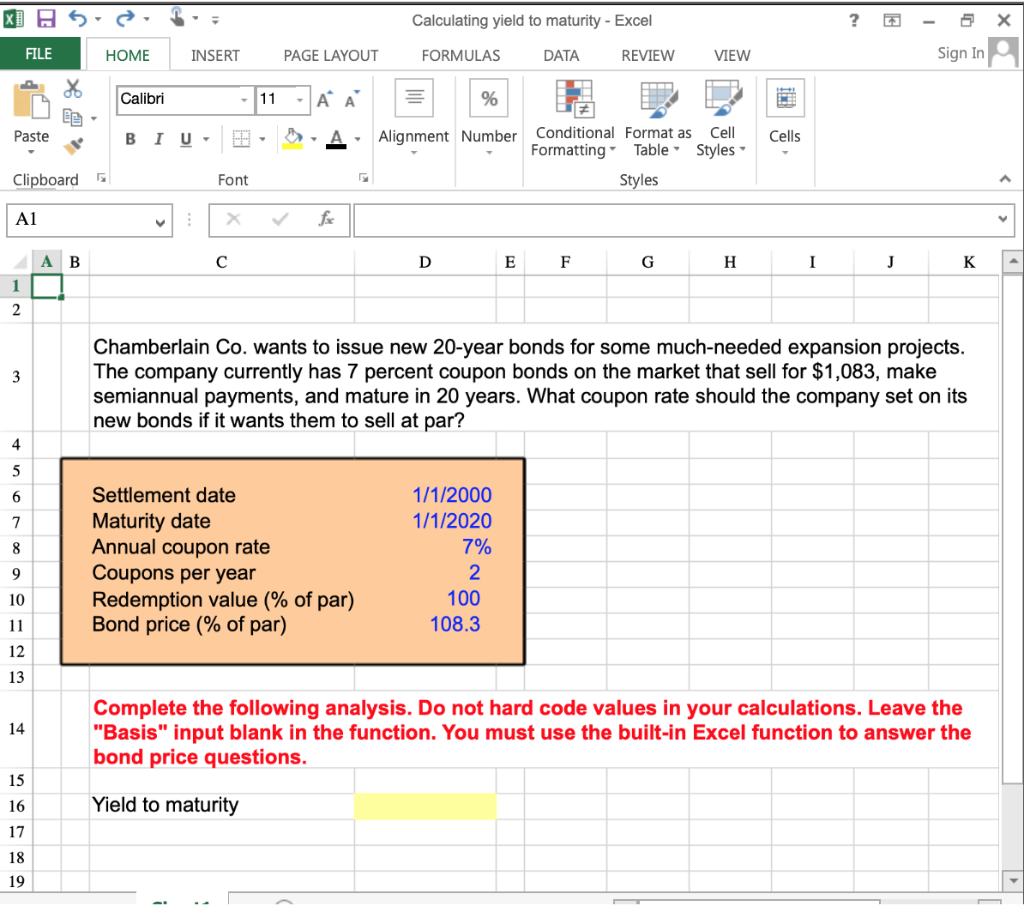

Yield to maturity is one of the most used yield types in the fixed income market;How to Calculate Bond Yield to Maturity Using Excel Open a Blank Excel Spreadsheet In Excel click "File" then "New" using the toolbar at the top of the screen Set Up the Assumption Labels Enter the Dates Enter the settlement date into cell B2 The settlement date is when an investor buys theYield to maturity is calculated using the IRR function on a mathematical calculator or MS Excel Semiannual yield to maturity in this example is calculated by finding r in the following equation r comes out to be 115% Relevant annual before tax cost of debt is just the relevant APR which his 23% (2 × 115%)

Best Excel Tutorial How To Calculate Yield In Excel

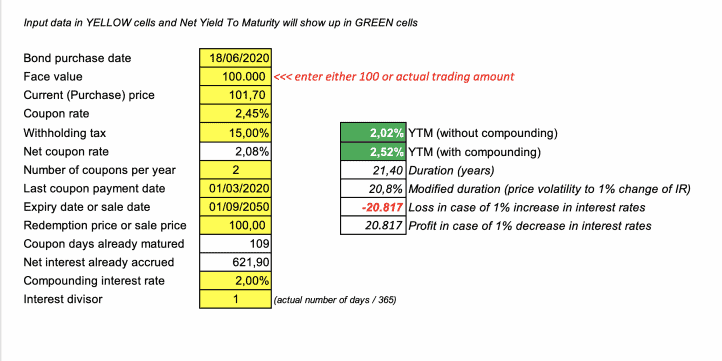

Bond Net Yield To Maturity Calculator Efinancialmodels

For callable bonds, knowing the coupon rate and yield to maturity only tells you part of the story To make informed investment decisions, you need to know what the bond's yield would be if itThe Excel ODDFYIELD stands for odd first yield, it is categorized under financial functions, wherein it calculates the yield of a security that has an odd (short or long) first period Purpose of Excel ODDFYIELD Function To get yield security with an odd first period Return value ODDFYIELD function returns the yield as a percentage Syntax =ODDFYIELD (sd, md, id, fd, rate, pr, redemTime To Maturity Analysis Using a spreadsheet to carry out Time To Maturity Analysis (YTM set as constant of 10%) Use Basis of ACTUAL/ACTUAL Tenor in years 1 Ref Yield 05% Ref Yield Ref Yield 05% Days in a year 365 Settlement date 3 Jan Maturity date 2 Jan 21 Annual coupon rate 1000% YieldToMaturity (YTM) 95% 1000% 105%

Excel Yield Function

Bond Duration Formula Excel Example

The formula's syntax is YIELD (settlement, maturity, rate, pr, redemption, frequency, basis Settlement refers to the settlement date ie the reference date for pricing, maturity is the maturity date ie the date on which the securityholder receives principal back, Pr stands for the current market price of the security;Frequency refers to number of periodic interestThe Excel ODDFYIELD stands for odd first yield, it is categorized under financial functions, wherein it calculates the yield of a security that has an odd (short or long) first period Purpose of Excel ODDFYIELD Function To get yield security with an odd first period Return value ODDFYIELD function returns the yield as a percentage Syntax =ODDFYIELD (sd, md, id, fd, rate, pr, redem

Learn To Calculate Yield To Maturity In Ms Excel

Floating Rate Notes Frn In Excel Understanding Duration Discount Margin And Krd Resources

My school book shows that the yield to maturity = dollar amount of annual interest face value market value / the number of period of times which = market value face vale / 2 = 60 1000 900 / 10 which again = 900 1000 / 2 which equals 0074 or 7To calculate the current yield, click inside the cell B11 and enter the formula "= (B1*B2)/B9" (without double quotes) To calculate the yield to maturity, click inside the cell B12 Go to Formulas (main menu) > Financial (in the Function Library group) and select the RATE function You will get a window like thisMy school book shows that the yield to maturity = dollar amount of annual interest face value market value / the number of period of times which = market value face vale / 2 = 60 1000 900 / 10 which again = 900 1000 / 2 which equals 0074 or 7 4 I have no idea where the number 2 comes from, and why it is used

Chapter 11 Bond Prices And Yields

Professional Bond Valuation And Yield To Maturity Spreadsheet

Yield to Maturity Formula refers to the formula that is used in order to calculate total return which is anticipated on the bond in case the same is held till its maturity and as per the formula Yield to Maturity is calculated by subtracting the present value of security from face value of security, divide them by number of years for maturity and add them with coupon payment and after that dividing the resultant with sum of present value of security and face value of security divided by 2N = Years to maturity This is the most accurate formula because yield to maturity is the interest rate an investor would earn by reinvesting every coupon payment from the bond at a constant rate until the bond reaches maturity If you had a discount bond which does not pay a coupon, you could use the following formula insteadFormula Description (Result) Result =YIELD(,A3,,A5,A6,,A8) The yield, for the bond with

How To Calculate Bond Yield In Excel 7 Steps With Pictures

How To Calculate Spot Rates Forward Rates Ytm In Excel Financetrainingcourse Com

Settlement = 25 October 18 Maturity = 25 October 21 (3 years) Rate = 6% Pr = (per 100 face value) Redemption = (per 100 face value) Frequency = 2 (every 6 months) Basis = 0 (US (NASD) 30/360 basis) Yield to maturity = YIELD(Settlement, Maturity, Rate, Pr, Redemption, Frequency, Basis) Yield to maturity = YIELD(DATE(18,10,25), DATE(21,10,25), 6%, , 100, 2, 0) Yield to maturity = 7%N = number of semiannual periods left to maturity Let's take an example to understand how to use the formula Let us find the yieldtomaturity of a 5 year 6% coupon bond that is currently priced at $850 The calculation of YTM is shown below Note that the actual YTM in this example is 987%The formula for calculating the yield to maturity on a zerocoupon bond is Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Consider a $1,000 zerocoupon bond that has

1

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

You could use your assumed rate divided by 2 or 4 for semiannual or quarterly coupons, but " (1 yield)^ (1/n) 1" will be more accurate 6) discount the PV of the coupons from the next coupon date (the effective date of the calculation above) back to the settlement dateY Yield to maturity P = C/(1y)^1 C/(1y)^2 C/(1y)^3 C/(1y)^n F/(1y)^n Now let's assume C, F and P are given, I want to obtain y with a VBA tool, what's my play?Yield to Maturity, YTM Definition The yield to maturity (YTM) of a bond is the internal rate of return (IRR) if the bond is held until the Formula To solve the equation above, the financial calculator or MS Excel is needed Annual YTM = (1 Semiannual Example A private investor has

Holding Period Return On Option Free Fixed Income Securities Excel Cfo

Bond Key Rate Duration Krd In Excel Calculating And Understanding Resources

How To Use The Yield Function In Excel

Yield To Maturity Calculation In Excel Example

Yield To Maturity And Duration Calculator

How To Calculate Yield To Maturity In Excel With Template Exceldemy

How To Use The Excel Yield Function Exceljet

How To Calculate Spot Rates Forward Rates Ytm In Excel Financetrainingcourse Com

Yield To Maturity Formula Step By Step Calculation With Examples

Quant Bonds Between Coupon Dates

Zero Coupon Bond Yield Excel

What Is Yield To Maturity Ytm Millionacres

Yield To Maturity Ytm Calculator

Files Transtutors Com Cdn Uploadassignments 2 Q Attachment 1 Pdf

What Is Yield To Maturity How To Calculate It Scripbox

Deriving The Bond Pricing Formula

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

How To Calculate Yield To Maturity In Excel With Template Exceldemy

How To Calculate The Yield To Maturity Of A Bond Or Cd With Excel Youtube

Finding Yield To Maturity Using Excel Youtube

Bond Yield To Maturity Calculator Exceltemplates Org

Yield To Maturity Ytm Overview Formula And Importance

Learn To Calculate Yield To Maturity In Ms Excel

Best Excel Tutorial How To Calculate Ytm

How To Calculate Bond Price In Excel

Calculating Bond S Yield To Maturity Using Excel Youtube

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Bond Yield To Maturity Calculator Exceltemplates Org

How To Use The Yield Function In Excel

Yield To Maturity Formula Step By Step Calculation With Examples

Excel Yield Function Equivalent In Python Quantlib Quantitative Finance Stack Exchange

Vba To Calculate Yield To Maturity Of A Bond

How To Calculate Pv Of A Different Bond Type With Excel

Price Function Calculate Bond Price Excel Google Sheet Automate Excel

3 Ways To Bootstrap Spot Rates For The Treasury Yield Curve Excel Cfo

How To Calculate Bond Yield In Excel 7 Steps With Pictures

How To Calculate Bond Yield In Excel 7 Steps With Pictures

How To Use The Excel Yieldmat Function Exceljet

Q Tbn And9gcqx2rkld6ury5os8uirtcnc50sedadn8kmuq3amc Qqkndcoxwv Usqp Cau

How To Use The Excel Tbillyield Function Exceljet

Calculating The Constant Yield Using Excel Gaap Logic

Quant Bonds Between Coupon Dates

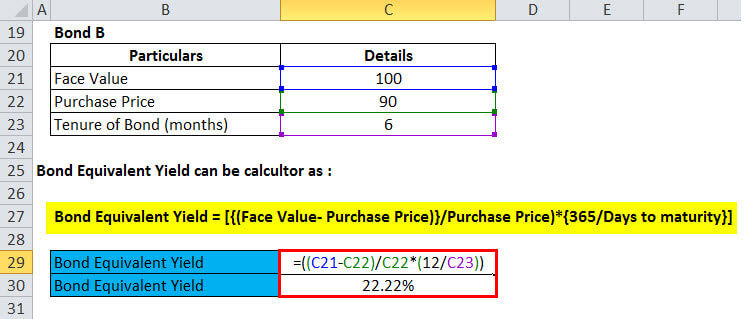

Bond Equivalent Yield Formula Calculator Excel Template

Interest Rates Use Ms Excel S Yield Function To Understand The Bond Market The Economic Times

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

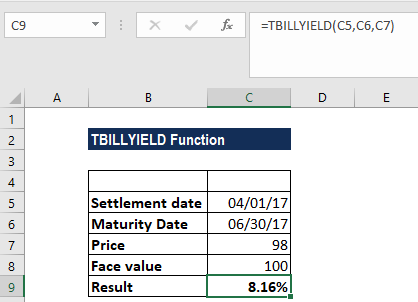

Tbillyield Function Formula Examples Calculate Bond Yield

How To Use The Excel Mduration Function Exceljet

Yield To Maturity Ytm Definition Formula Method Example Approximation Excel

Frm How To Get Yield To Maturity Ytm With Excel Ti Ba Ii Youtube

Solved All Answers Must Be Entered As A Formula Click Ok Chegg Com

How To Calculate Spot Rates Forward Rates Ytm In Excel Financetrainingcourse Com

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Bond Yield To Maturity Calculator Printer Driver Printer Batch File

Solved X 5 X Home Calculating Yield To Maturity Exc Chegg Com

Duration Calculating The Annual Duration Of A Security

Yield Function Formula Examples Calculate Yield In Excel

Bond Price Calculator Present Value Of Future Cashflows Dqydj

Learn To Calculate Yield To Maturity In Ms Excel راهنما شبکه اطلاع رسانی طلا و ارز

Excel Ytm Calculator Calculator Spreadsheet Free Download

Solved Calculating Yield To Maturity Excel Home Insert Chegg Com

Bond Yield Formula Calculator Example With Excel Template

Yield To Maturity Approximate Formula With Calculator

Function Duration

Excel For Finance Top 10 Excel Formulas Analysts Must Know

Excel Finance Class 48 Calculate Ytm And Effective Annual Yield From Bond Cash Flows Rate Effect Youtube

Yield To Maturity Formula Step By Step Calculation With Examples

Excel Yield Function

Bond Pricing Valuation Formulas And Functions In Excel Youtube

Microsoft Excel Bond Valuation Tvmcalcs Com

Q Tbn And9gctacaieid4sboc7gfwy42ckuxutk9izg3v4wua1wzgqipvknrom Usqp Cau

Yield Function In Excel Calculate Yield In Excel With Examples

Yield Function In Excel Calculate Yield In Excel With Examples

Best Excel Tutorial How To Calculate Ytm

Yieldmat Excel Financial Function

Excel Yield Function Double Entry Bookkeeping

Free Bond Valuation Yield To Maturity Spreadsheet

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

コメント

コメントを投稿